Building a Compounding Machine

Lessons from Constellation Software

Mark Leonard worked as a gravedigger, a bouncer, draftsmen, furniture removalist, venture capitalist… and then went on to build an $80 billion Conglomerate at Constellation Software.

What’s more - he started the business with only $25 million Canadian dollars in 1995, up nearly ~3200x since then.

But unlike most amazing compounders, Constellation software isn’t just one company, it’s a conglomerate consisting of over 3000 vertical market software businesses.

In 2022 - Constellation bought 134 businesses (averaging a deal every 2.7 days).

This is the story of Mark’s incredible journey building a powerhouse in the software industry.

Let’s begin.

Leonard’s Background

Like many iconoclastic founders, Leonard has an incredible unconventional background

In University, he spent time working as a stonemason part time alongside his studies. He read widely and broadly, and studied across many different faculties at his University, before eventually graduating with a Bachelor of Science.

It’s quite difficult to find much information on Leonard, because he refuses to do interviews, and is one of the most private individuals that runs a public company.

What was apparent in Mark’s background was that he spent time interning at an investment Bank Barclays.

But whilst he was there, one of his seniors told him that he would make a terrible banker.

So instead, the Managing Director told him to look into some of their clients and see if any of their backgrounds jumped out to him.

That is when Mark decided he would become a venture capital investor in Canada.

His fund didn’t perform particularly well (single digit returns), but Mark’s takeaway from that experience was that he was playing the wrong game.

He realised that there were a large number of businesses that existed in markets that were too small to attract competition.

Huge businesses could never be built in these markets, but small, profitable vertical SaaS businesses could…

Building an acquisition machine

Realising that there were a large number of fragmented markets that could be rolled up, Mark raised $25 million Canadian dollars to go after the opportunity.

His criteria was simple, he would go after businesses that were:

Mid-to-large-sized vertical market software companies (a minimum of $1-million earnings before interest and tax)

Consistent earnings and growth — generally EBITDA/revenue + revenue growth of 20 percent or more per year

Experienced and committed management

An offering price that has been determined

Having experienced the pressure of incentives in venture capital to flip assets, Mark structured constellation as a permanent capital vehicle that could hold these wonderful businesses forever.

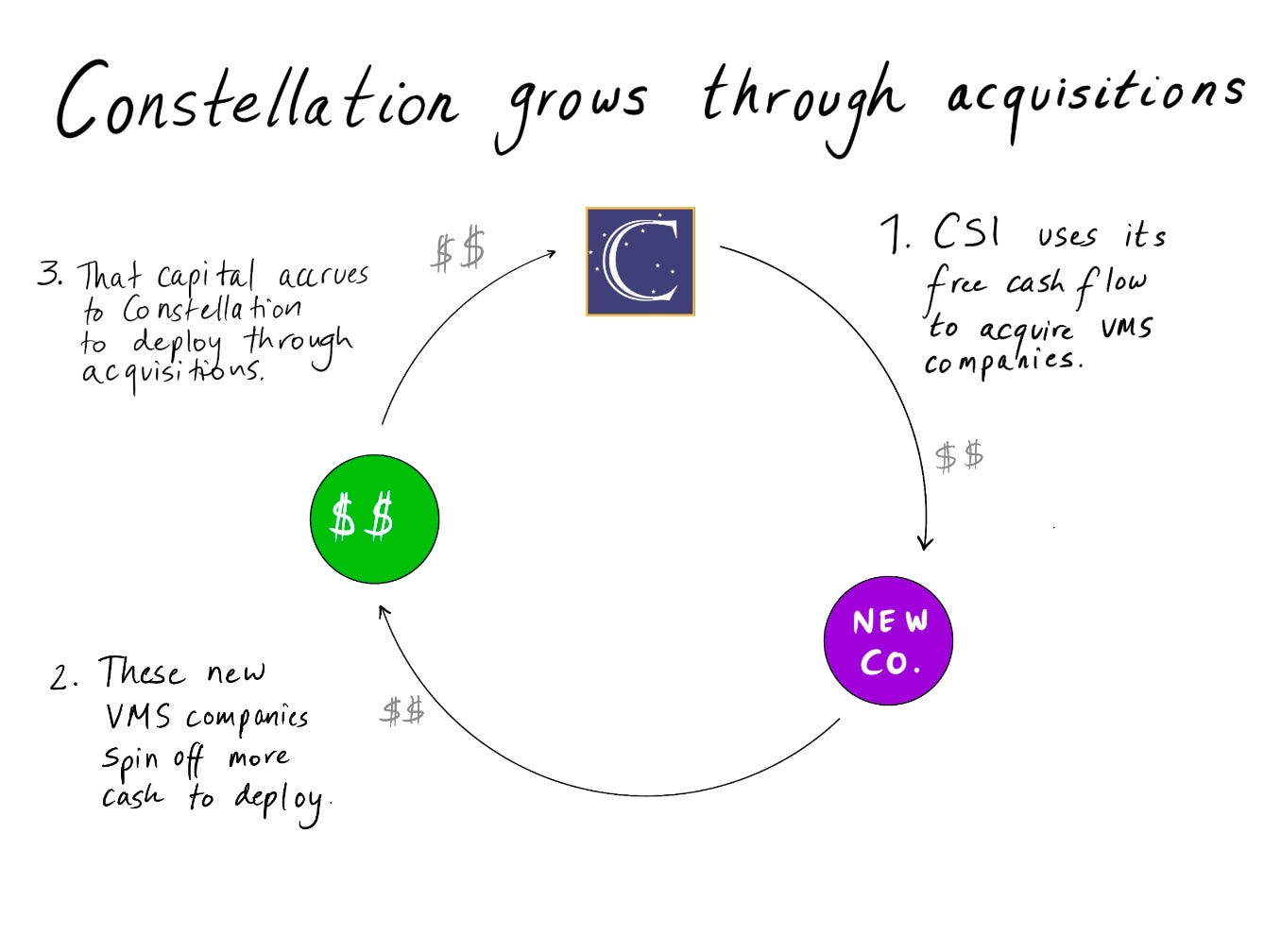

Given how small these businesses are, constellation typically acquires companies for ~0.8x revenue, which is incredibly cheap. They are then able to use the cashflows generated by these businesses to fuel further acquisitions, creating a virtuous cycle of growth.

Source - The Generalist

Today, Constellation managed 700+ software businesses in their portfolio.

Why are Vertical Market Software Businesses so Special?

Looking back at his venture portfolio, Leonard realised that some of the most incredible businesses were vertical market software companies

VMS businesses are sold on a subscription basis, meaning revenues are very predictable.

Vertical markets attract less competition because the TAMs are relatively smaller.

VMS businesses are also capital efficient, requiring very little Capex, which is one of the reasons why the acquisition engine works so well.

More striking however is that these businesses seem to have strong pricing power within their markets.

CSI stopped disclosing how much price increases contributed to revenue growth, although when they did, it was in the mid-high single digit range, suggesting that these businesses have pricing power well above rates of inflation.

The only problem with these businesses is that they tended to be small … too small to require venture capital dollars and achieve outsized returns.

But by bundling many of these businesses together, perhaps it would be possible to build a compounding machine.

And possible it was.

Pricing Discipline

Constellation has a 30% IRR hurdle for acquisitions of less than $1m in revenue, 25% for companies generating $1m - $4m in revenue, and 20% for companies generating north of $4m in revenue.

These high hurdle rates of return force discipline upon management at CSI to not overpay for companies on the way in, and is one of the reasons why Constellation has maintained such high returns on capital.

Show me the incentive and I’ll show you the outcome

The influence of Buffett and Munger on Constellation is most apparent in the way that Leonard structures management and executive compensation packages at the group.

To avoid the effects of dilution, CSI issues no equity compensation to employees.

However, they do pay employees well in cash, and require that a large proportion of bonus cash compensation is used to purchase common stock.

This creates a strong culture of ownership at CSI without the dilutive effects of ESOP pools seen at many of the FAANG companies, whilst also creating upwards pressure on the stock price.

Leonard himself is the largest shareholder in Constellation with nearly 7% of the company’s stock.

Company Structure

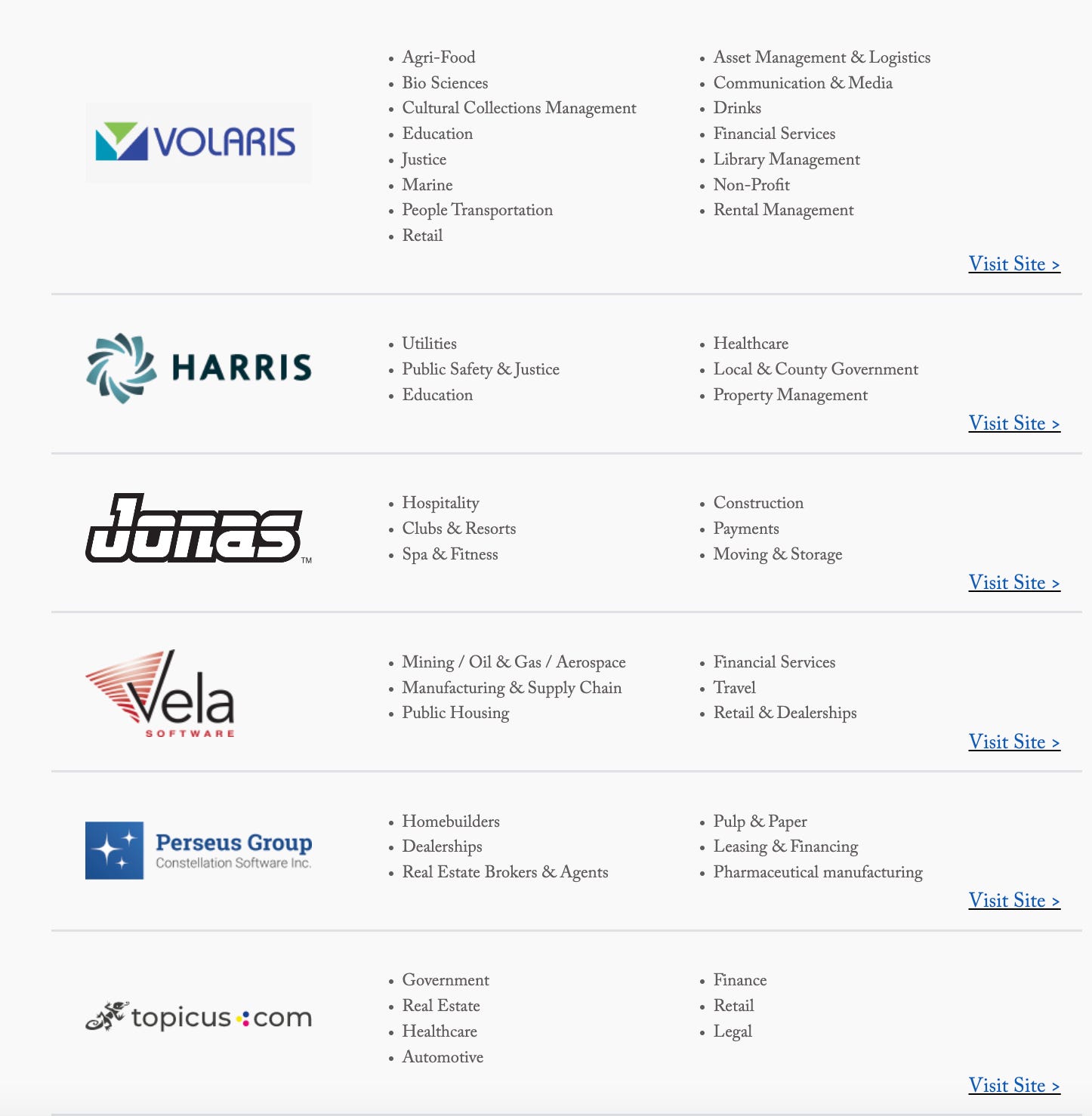

Source - Constellation Software Website

Constellation Software is a Babushka Doll of a business.

Companies, within companies within companies.

On their website, they list 6 key businesses that they own.

But these businesses themselves, are holding companies, consisting of hundreds of smaller companies within them.

More striking perhaps is that Constellation incentivises individual contributors to eventually become acquirers of businesses themselves.

This culture of acquisitions has created a well-oiled machine capable of growing

By The Numbers.

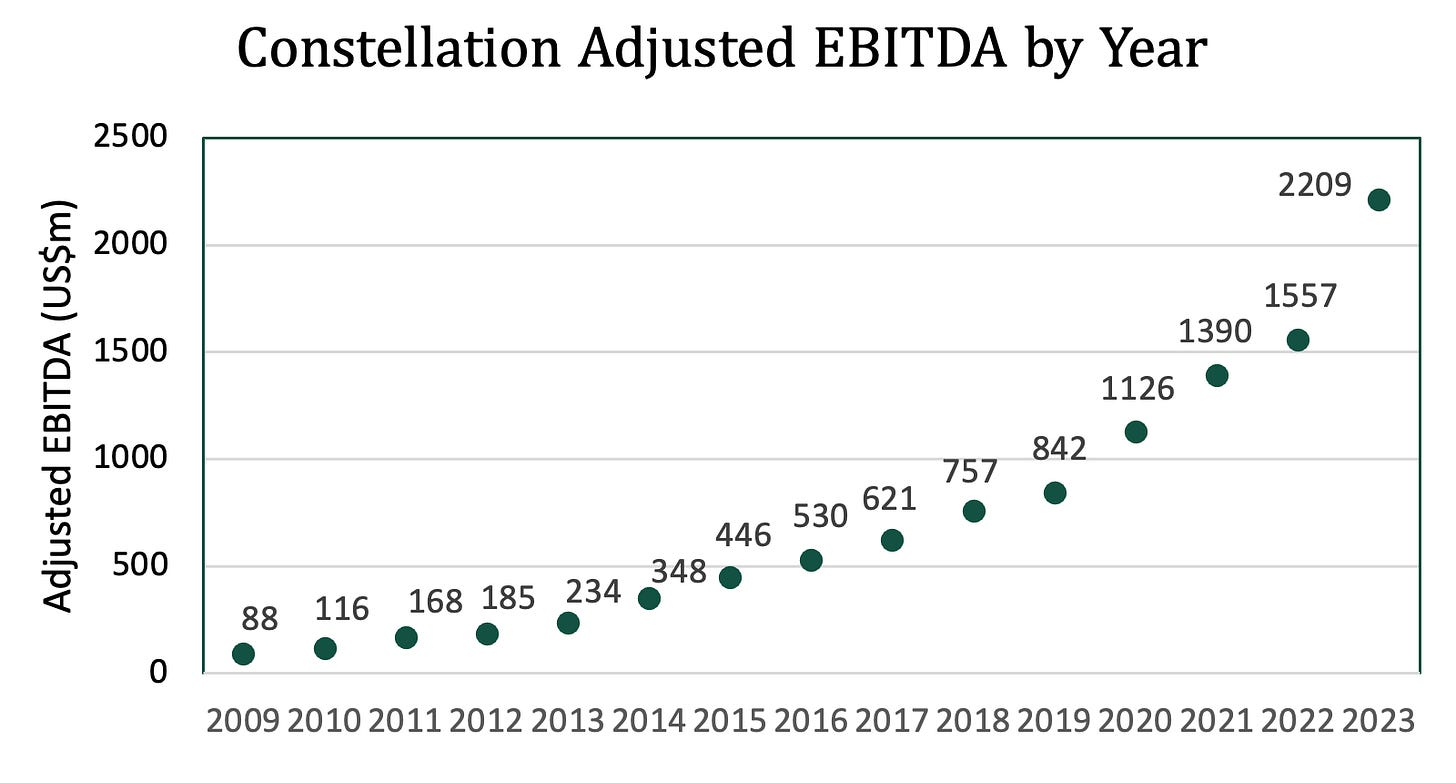

In 2023, Constellation did $4.025 billion in Adjusted EBITDA, up from $2.667 billion in the previous year, and up from $757 million in CY2018.

Pretty Crazy Numbers.

They also repurchased nearly $1 billion in shares in FY2023, which will help to

What’s more striking perhaps is that CSI’s Adjusted EBITDA has consistently grown nearly every year since IPO whilst maintain ~20-28% EBITDA margins consistently.

Source - CSI Company Annual Filings 2023-2010

Lessons on Management

It is often said that the best businesses are an authentic expression of their founders, and this is certainly true in the case of Constellation software.

Mark has a strong distaste for telling others what to do, and a strong sense that freedom is important.

From experiences getting belted by teachers, leaving home early and building a flamethrower, throughout his life, Mark was a free soul unencumbered by the dogma of society.

Accordingly, Constellation is an organisation of freedom, decentralisation and autonomy.

Within Constellation, Leonard places full trust within each of the operating groups to make effective decisions independently. In fact, most of acquisitions made by Constellation aren’t even approved at the board level, decisions are made by general managers within each of the core operating groups.

Studying High Performance Conglomerates

In his time building Constellation, Leonard took the time to study other high performance conglomerates.

What he realised is that returns on capital tend to revert to the means in the long run.

High performance cultures are difficult to sustain, and often fleeting.

Entropy is the default state of the universe.

Another key takeaway from these high performance businesses was to work incredibly closely with the customer to build great products.

In the words of Paul Graham, business is as simple as building something people want.

And working with customers is critical in ensuring that your products solve a real problem.

The Future of Constellation

Private investors are becoming increasingly comfortable investing in software assets.

Thoma Bravo and Vista Equity Partners have shown that vertical software businesses are not ‘risky’ assets to own, but incredible asset light businesses that can generate exceptional returns.

As a result, moving forwards, I think there will be increasing competition for a finite number of assets.

In the words of Jeremy Giffon “There are only so many of these assets that exist, and Constellation has them all in one spreadsheet”

Strikingly, Constellation’s success has attracted a swathe of copycat investors, many very successful in their own right including Andrew Wilkinson at Tiny Capital and Colin Keeley to name a few.

As Private Equity wakes up to the reality that software businesses are superior to old-school industrial style businesses, with subscription revenue, 80%+ gross margins and customer data lock in, multiples should increase.

Further Reading

Mark Leonard’s Only Ever Interview