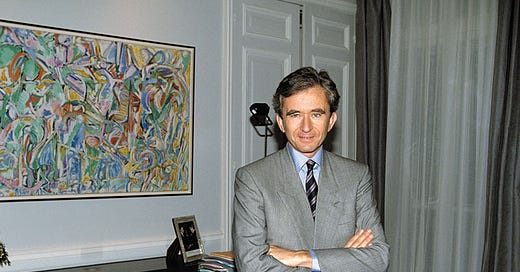

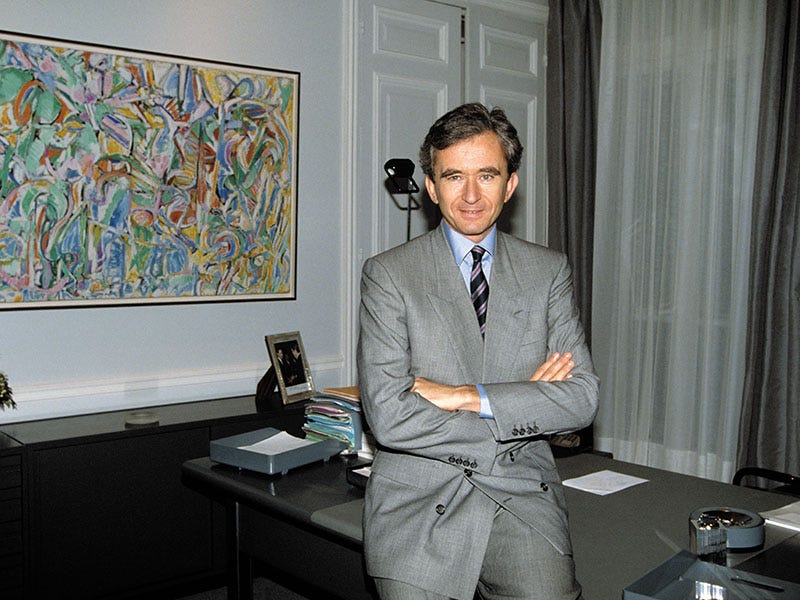

“I am the boss. I shall be here on Monday morning and I shall be running the company in person.” - Bernard Arnault, 1984

Early Career

As a fresh-faced 22 year old, Bernard was already beginning to show signs of greatness.

After joining his father’s construction firm Ferret-Savinel 6 months early, whilst still studying at Ecole Polytechnic, Bernard immediately got to work.

Where others would have taken a backseat role in the successful family business, Benard was pushing the envelope, asking difficult questions of Ferret-Savinel, their projects, and internal operations.

In 1977, Bernard then architected a move to sell the assets of his father’s general construction company to the Rothschild’s owned “SNC (Société Nationale de Construction)”. Although he made this decision without his father’s approval, the 40-million franc contract proved too great to turn down for his father.

He now well and truly had the reigns of the family business.

Benard was in the driver's seat.

Pivoting into the property development space, Benard launched a new subsidiary called Ferinel. What started as a small endeavour quickly grew, building only one house in 1978, although subsequently building 100 in 1979, and 1000 houses in 1980. Within 5 years, Ferinel was the leading private property developer in France.

Entering Luxury - The Acquisition of Dior

In 1984, a French Company called ‘Boussac’ was going into receivership.

The business had 6 months to close a deal or otherwise it would be forced to shut down its operations and liquidate its assets. Whilst there were a range of businesses sitting underneath heavily levered Boussac, held by the fledgling Willot Brothers, there was one gem - Christian Dior. An iconic french luxury brand.

Arming himself with Lazard’s premier restructuring banker Antoine Bernheim, Arnault competed fiercely with another conglomerate to win the deal. After much indecision over which party would win the deal, with similar financial offers, Ferinel won the deal given that “there was only one party that really wanted Boussac”... “and that was Bernard Arnault”. He simply wanted it more.

Upon closing the deal, Bernard set to ensure that Dior embodied “everything that is most beautiful in the world.”

Whilst the products sold in France were of exceptional quality, abroad, there were a range of products with varying levels of polish. Recognising the importance of perfection, Bernard steered production to focus on exquisite products across all geographies.

By 1987, Boussac was humming. Having sold off some underperforming textile assets, there were only two key businesses left, generating over 11 billion franc in revenue and 445 million in profits.

Restructuring the Business

A master of financial engineering, Bernard quickly realised that instead of holding 51% of a company itself, it would be superior to hold 51% of a company which itself, held 51% of the underlying asset.

This ‘russian doll’ structure would reduce the capital required to make takeover offers on much larger businesses, allowing the Arnault Group to continue to climb in the financial world.

From Perfume to Champagne - The Acquisition of LVMH

As Arnault’s existing businesses were beginning to roll, the share market slump of 1987 proved a fruitful time for Arnault in the market.

Recognising the opportunities that would be available in public markets, Arnault sought a quick sale of his French nappy and textile companies, freeing up over 6 billion francs in Arnault’s war chest.

In the meantime, shares in the conglomerate LVMH had fallen nearly 50% in 6 months, from ~2500 Francs to nearly ~1270 Francs. Internally, LVMH was a mess, with internal fighting between Alan Chevalier and Henry Racamier.

Architecting his move to takeover LVMH, Bernard launched a 30% takeover offer for the business.

But Benard’s initial deal received significant pushback from his Lazard bankers, arguing that such a deal would be impossible.

Recognising that the opportunity was too good to pass up, Benard persisted.

He managed to negotiate a deal between Guiness, who were looking to enter LVMH, the Moet Hennessy family, and Chevalier, who was convinced the deal would help him win the upper hand in his power struggle against Henry Racamier.

At 1am on the morning of the 27th of June 1988, a deal was struck, and Benard was one step closer to controlling the ‘crown jewel’ of luxury business.

Cementing Power

After gaining initial power within LVMH, in Stalinist style, Bernard sought to remove of Henry Racamier, his primary opposition.

After an arduous power struggle, and extensive legal battle’s, Benard was able to thrust Racamier out of the company, “dropping his mask” and revealing his true skills in manoeuvring within the organisation.

LVMH Today

What started as a $15 million capital investment into Boussac has now ballooned into a $350 billion Euro behemoth in LVMH, with Benard’s personal fortune now amounting to ~193bn euros, making him the Richest men in the world.

In 2023, LVMH recorded 88 billion Euros in Revenue with ~26.5% profit margins, with LVMH stock is up 36x since floating in 1995.

The group has continued to acquire generational brands, including Marc Jacobs, Tag Heuer, Gucci, Hermes, Bulgari and Tiffany & Co.

The incredible brand identities of their holding companies has allowed LVMH to maintain pricing power and hold strong margins over time, driving most of the compounding in the stock price.

Key Lessons

1. Go big or go home

One thing striking about Bernard is his willingness to be bold when others where fearful, and swing big in the face of uncertainty.

2. You don’t need more intelligence, you need more courage

Whilst Benard’s striking intellect is apparent, his best decisions were driven by the courage to continue pushing where others would have been disheartened, not by analysis or ‘overthinking’ things.

3. Never underestimate the power of brands

The incredible compounding machine of LVMH has been driven primarily by the compounding success of their brands, which have grown from luxury French to global icons in a world driven by social media.

When Benard acquired Boussac in 1984, he understand the residual value in the Dior Brand.

This is what created almost all of the value.

After gaining initial power within LVMH, in Stalinist style, Bernard sought to remove of Henry Racamier, his primary opposition.

After an arduous power struggle, and extensive legal battle’s, Benard was able to thrust Racamier out of the company, “dropping his mask” and revealing his true skills in manoeuvring within the organisation.

4. Never compromise on quality

“Money is just a consequence. I always say to my team, don’t worry too much about profitability. If you do your job well, the profitability will come … When we discuss a brand, I always tell them my real concern is what the brand will be in five or ten years, not the profitability in the next six months. If you take a brand, like Louis Vuitton, which is the number one luxury brand in the world, what I am interested in is how we can make it as admired and successful in ten years as it is today. It’s not how much we’re going to make next year.” - Bernard Arnault

The incredible success of the brands within LVMH has been driven by an obsession with product quality, ensuring that all of the businesses have incredible attention to detail.

Building best in class products is not incrementally valuable, it is orders of magnitude more valuable.

5. Trust creatives to run the ship

“LVMH is, as a company, [is] so decentralized. Each brand very much runs itself, headed by its own artistic director. Central headquarters in Paris is very small, especially for a company with 54,000 employees and 1,300 stores around the world. There are only 250 of us, and I assure you, we do not lurk around every corner, questioning every creative decision.” - Bernard Arnault

Within each brand, Bernard places full trust in the creative team to drive product teams and the direction of the brand, knowing his role as the financier and businessman and letting creatives run the ship.

6. Position Sizing Matters

Well, we don’t like failures. We try to avoid them. That is why, with many of our new products, we make a limited number. We do not put the entire company at risk by introducing all new products all the time. - Bernard Arnault

Bernard never bets the farm on a single product category or decision. Risks that LVMH takes on are calculated and measured.

Further Reading

The Taste of Luxury: Benard Arnault and the Moet-Hennessy Louis Vuitton Story

Love the write up! Could you explain in more detail how this works? "This ‘russian doll’ structure would reduce the capital required to make takeover offers on much larger businesses, allowing the Arnault Group to continue to climb in the financial world."

I would listen to Acquired’s podcast on LVMH if I were you